1. Market Overview

1.1 Global market size and growth trends

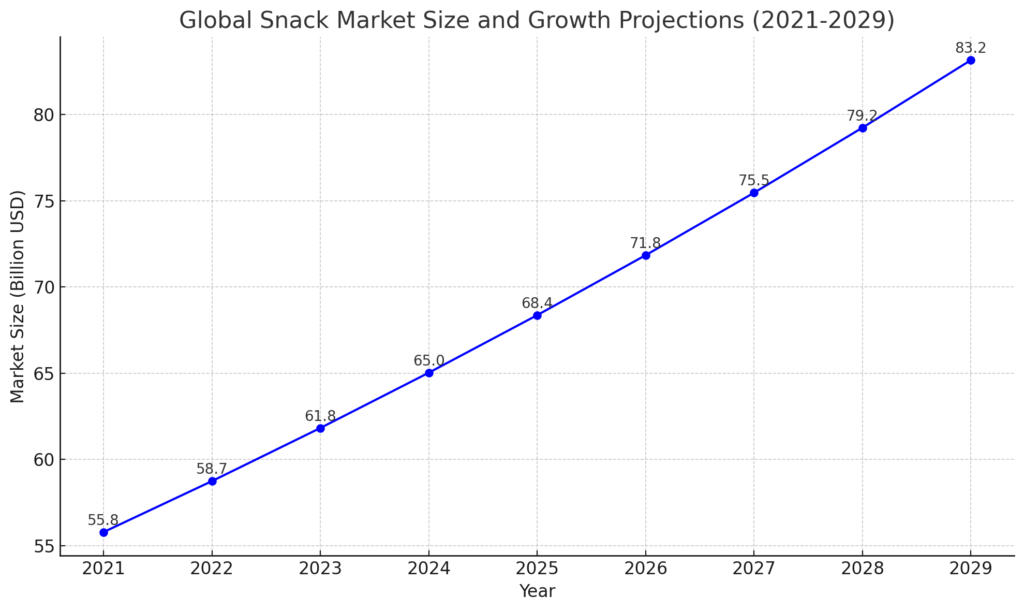

The global snack market has experienced significant growth in recent years, driven by increasing consumer demand for convenience and diverse snack options. According to statistics, the global snack market will be worth US$55.785 billion in 2021, and is expected to grow at a compound annual growth rate of 5.3% from 2022 to 2029, reaching a scale of US$83.860 billion by 2029.

Demand for snacks has also increased during the COVID-19 pandemic as people spend more time at home. Compared with 2019, the global market grew by 3.67% in 2020. In addition, as consumers’ consumption trend towards healthy food increases, there is a growing demand for low-fat, low-calorie and sugar-free snack products.

1.2 Regional market analysis

The snack market in various regions shows different characteristics and growth trends. For example:

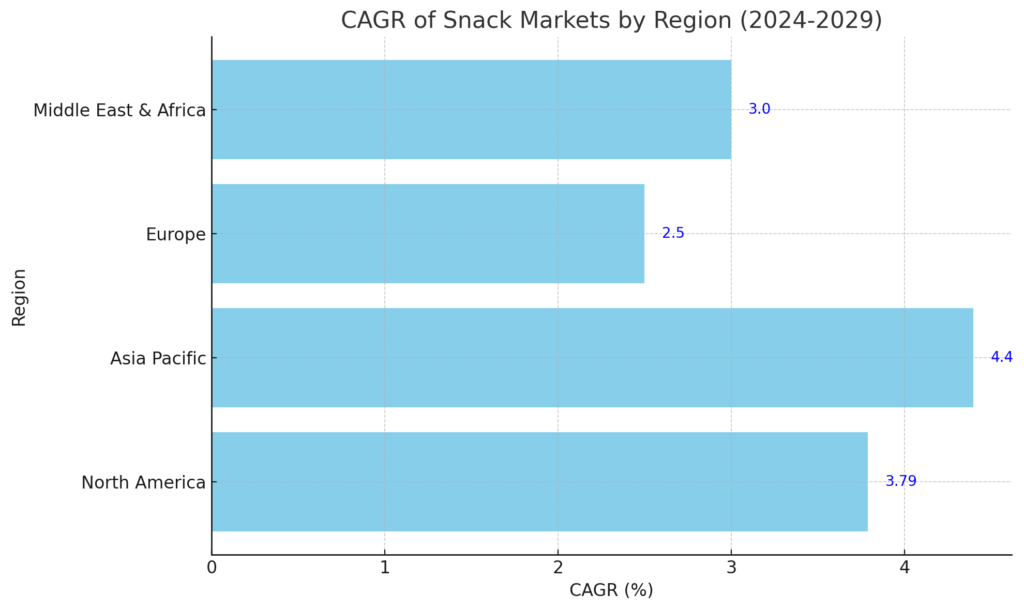

- North American Market: North America is one of the largest consumer markets for snack products. According to a report by Mordor Intelligence, the North American snack food market is expected to grow at a compound annual growth rate of 3.79% between 2024 and 2029. The growth of the US and Canadian markets is mainly driven by increasing health awareness and changes in lifestyle.

- Asia Pacific Market: The Asia Pacific region, especially China, India and Japan, has huge growth potential in the snack market due to its large population base and rapid economic development. According to Business Market Insights, the frozen snack market in the Asia Pacific region is expected to grow from US$2,466.43 million in 2022 to US$3,472.11 million in 2030, showing a compound annual growth rate of 4.4%.

- European Market: The European market is dominated by healthy and natural snacks, and organic and natural snacks are very popular in the region. However, the specific market data and growth rate need further research to determine.

- Middle East and African Markets: Although these regions may not be as prominent in snack consumption as other regions, the markets in these regions are gradually growing with globalization and the westernization of lifestyles.

Overall, the global snack market is affected by multiple factors, including changes in consumer preferences, increasing health awareness, and levels of economic development. As the market continues to evolve, snack production companies need to continue to innovate to meet the needs of consumers in different regions.

2. Consumer behavior and preferences

2.1 Health awareness and product demand

As consumers become more aware of healthy eating, the snack production industry is also facing new challenges and opportunities. Increased health awareness has prompted consumers to be more inclined to choose snack products that are low in sugar, low in fat, high in protein or rich in fiber.

- Market demand growth: According to market analysis reports, the size of the healthy snacks market is expected to grow from US$25.626 billion in 2023 to US$55.926 billion in 2028, with a compound annual growth rate of 16.89%.

- Product Innovation: To meet consumers’ demand for healthier snacks, manufacturers continue to launch new product lines, such as snacks rich in superfoods, plant-based snacks, etc., which usually boast less processing and more natural ingredients.

2.2 Consumption habits of different age groups

Consumers of different age groups show different preferences and habits in snack consumption, which provides snack manufacturers with opportunities to segment the market.

- Young consumers: Millennials prefer snack products that are convenient, novel, and have social sharing attributes. They have higher requirements for novel flavors and packaging designs.

- Middle-aged and elderly consumers: In comparison, the middle-aged and elderly groups are more concerned about the health attributes of snacks, such as no added sugar, low sodium, etc. They may prefer traditional, time-tested snack brands.

- Consumption data: According to statistics, snack consumption has increased during the COVID-19 pandemic, especially during home isolation, when consumers tend to seek comfort and relieve stress through snacks.

The above data shows that the snack production industry needs to constantly adapt to changes in consumer behavior and preferences, and meet the needs of different consumer groups through product innovation and market segmentation.

3. Product innovation and trends

3.1 Flavor innovation and cultural integration

As globalization continues to deepen, consumers are increasingly exploring and experimenting with food flavors. The snack industry is meeting this demand through flavor innovation, incorporating ingredients and cooking methods from different cultural backgrounds into product development.

- Global Flavor Fusion: Snack products are beginning to use unique flavors from around the world, such as Mexican chili, Italian vanilla, Thai curry, etc., to enrich consumers’ taste experience.

- Localized innovation: At the same time, snack manufacturers are also innovating based on local flavors, combining local specialty ingredients to develop snack products with regional characteristics.

- Consumer acceptance: According to market research, more than 60% of consumers are willing to try snack products with international or local characteristics, which shows that flavor innovation has broad market potential.

3.2 Functional and healthy products

Increasing health awareness has prompted consumers to pay more attention to the nutritional value and health benefits of snacks, and snack manufacturers are catering to this trend by developing functional and healthy products.

- Functional ingredients: Snack products enriched with functional ingredients such as protein, fiber, vitamins and minerals are emerging in the market to meet specific nutritional needs.

- Clean label: Clean label products, i.e. snacks that do not contain artificial additives, preservatives and genetically modified ingredients, are increasingly popular among consumers.

- Healthy certification: The market share of snack products with health certification, such as low sugar, low salt, gluten-free, etc., is increasing year by year, reflecting consumers’ strong demand for healthy snacks.

- Market data: According to statistics, the annual growth rate of functional snacks reached 7%, which is much higher than the growth rate of traditional snacks, showing the strong momentum of the healthy snack market.

4. Supply chain and distribution channels

4.1 Supply Chain Stability

The supply chain plays a vital role in the snack food production industry. It not only affects the procurement and cost of raw materials, but is also directly related to the quality and delivery capabilities of the final product.

- Raw material procurement: The snack food industry relies on a variety of agricultural products, such as potatoes, corn, nuts, etc. The stability of the supply of these raw materials directly affects production costs and product quality. For example, extreme weather events may lead to crop yield reductions, thus affecting the stability of the supply chain.

- Supplier Management: Leading companies in the industry usually establish long-term partnerships with suppliers to ensure continuity and quality control of raw material supply.

- Inventory Management: Effective inventory management is the key to supply chain stability. Enterprises use advanced forecasting tools and inventory management systems to reduce inventory backlogs and out-of-stock risks.

- Response strategy: Faced with uncertainties in the supply chain, companies adopt diversified procurement strategies and establish alternative supply chains to reduce dependence on a single supplier.

4.2 E-commerce and digital transformation

As consumer shopping habits change and technology develops, e-commerce and digital transformation have become important trends in the snack food industry.

- Online sales growth: According to market research, the sales of snack foods in the e-commerce channel are growing rapidly. Consumers are increasingly inclined to buy snacks online to enjoy a convenient shopping experience.

- Digital Marketing: Companies use digital tools such as social media, search engine optimization (SEO) and email marketing to increase brand awareness and engage consumers.

- Personalized recommendations: Through data analysis, companies can better understand consumer preferences and provide personalized product recommendations, thereby improving customer satisfaction and loyalty.

- Logistics and delivery: The development of e-commerce has also driven innovation in logistics and delivery services. Companies have established close cooperation with logistics partners to provide fast and reliable delivery services to meet consumers’ demand for instant gratification.

- Technological innovation: With the application of technologies such as artificial intelligence and machine learning, companies can manage inventory more efficiently, optimize supply chains, and provide more personalized consumer experiences.

5. Competitive environment and market opportunities

5.1 Analysis of Major Competitors

In the field of snack food production, the competition landscape is diversified and international. The following is an analysis of some major competitors:

- Market Leaders: Companies such as PepsiCo and Nestlé have a leading position in the market due to their strong brand influence, broad product lines and global distribution networks.

- Regional brands: Some regional brands have successfully built a loyal consumer base by focusing on specific market segments or local snacks.

- Emerging Brands: As consumer demand for healthier snacks grows, many emerging brands are quickly emerging by offering low-sugar, low-fat or organic snacks.

5.2 Market Entry Strategies and Opportunities

Market entry strategy and opportunity analysis need to consider the following key points:

- Consumer Preferences: Develop new products that meet market trends based on consumers’ demand for healthy, convenient and diversified snacks.

- Technological Innovation: Utilize advanced food processing technology to improve product taste, shelf life and nutritional value to meet consumers’ expectations for high-quality snacks.

- Market Segmentation: Identify and focus on market segments with growth potential, such as healthy snacks, functional snacks or snacks for specific consumer groups (e.g. children, athletes).

- Supply Chain Management: Establishing an efficient supply chain to ensure the quality and cost-effectiveness of raw materials while reducing environmental impact.

- Digital Marketing: Leverage digital tools such as social media, e-commerce and mobile apps to increase brand awareness and consumer engagement.

- Collaboration and Partnership: Establish partnerships with retailers, distributors and other food companies to expand market coverage and enhance market competitiveness.

- Regulatory Compliance: Pay close attention to and adhere to food safety and labeling regulations to ensure that products meet the legal requirements of the target markets.

6. Analysis of influencing factors

6.1 Impact of the epidemic on the market

The epidemic has had a significant impact on the snack production market. First of all, due to the decline in the number of people in supermarkets, restaurants, and entertainment venues during the epidemic control period, food and beverage consumption was suppressed, resulting in a decrease in demand for snacks. However, as residents’ incomes are affected, the lack of consumption scenarios and the decline in consumption power have become major concerns for the market. However, with the popularization of vaccination and the advancement of epidemic prevention methods, control methods have become more flexible and efficient, and passenger flow in consumer places has accelerated. Active fiscal policies have helped companies resume production and work, safeguarding residents’ lives, and direct consumption stimulation methods such as subsidies and shopping vouchers have Allowing consumption power to continue to recover.

During the epidemic, sales through online shopping channels surged, and consumers’ preference for online shopping increased significantly. For example, more than 40% of consumers chose online channels for shopping at the end of 2020, and 38% of consumers said they still expected to shop online after the epidemic. In addition, the direct-to-consumer D2C sales model is favored by consumers. Through the D2C platform, manufacturers can directly contact consumer needs, obtain first-hand consumption data, and tailor consumption plans for consumers.

After the epidemic, consumers’ consumption psychology has also changed, and they are paying more and more attention to healthy and sustainable living. When shopping for groceries, consumers are willing to pay a premium for products from brands that practice sustainability. This trend has prompted snack manufacturers to pay more attention to health and sustainability when developing products.

6.2 Regulatory and policy environment

The regulatory and policy environment also has an important impact on the snack production market. In recent years, the national and local governments have introduced a series of policies to promote consumption upgrades in the snack food industry. For example, the “Guiding Opinions on Cultivating Traditional Advantageous Food Production Areas and Local Specialty Food Industries” issued by the Ministry of Industry and Information Technology and other 11 departments in 2023 mentioned the cultivation of local specialty food industry clusters and the promotion of new momentum for the development of specialty food industries.

Provinces and cities also regulate snack food safety according to local conditions and propose development goals. For example, Xinjiang supports the construction of regional green food, organic agricultural product geographical indications and green food raw material bases, and strengthens food and drug safety supervision. These policies not only improve the quality and safety standards of snack products, but also provide policy support for the innovation and development of the snack industry.

In addition, national policies also include improving food safety laws and regulations, promoting business innovation, and encouraging companies to provide high-quality consumer products to meet consumers’ personalized and differentiated needs. The implementation of these policies will help enhance the overall competitiveness and market vitality of the snack industry.

7. Industry challenges and coping strategies

7.1 Health Issues and Market Restrictions

A major challenge facing the snack industry is the growing consumer demand for healthier foods. As health awareness increases, consumers are increasingly concerned about the sugar, salt and fat content in snacks. According to market research, more than 60% of consumers say they consider the nutritional value and health impact of products when choosing snacks.

- Health issues: Snacks are often criticized for being high in calories, fat and sugar, which is linked to the growing global problem of obesity and related chronic diseases.

- Market restrictions: Regulations and policies are also restricting the production and sale of unhealthy snacks. For example, some countries and regions have imposed taxes on high-sugar or high-salt products, prompting manufacturers to reconsider their product formulas.

7.2 Strategies for coping with market changes

To address these challenges, snack manufacturers are adopting a variety of strategies to adjust their product lines and market positioning.

- Product Innovation: Many manufacturers are developing snack products with low sugar, low salt and low fat to meet the needs of health-conscious consumers. For example, using natural sweeteners to replace traditional sugar, or developing healthy snacks rich in protein and fiber.

- Clean Label: “Clean label” products, those that avoid artificial additives and hard-to-pronounce chemical ingredients, are becoming increasingly popular in the market. Manufacturers are simplifying the ingredient lists of their products to increase transparency and consumer trust.

- Educating consumers: Snack companies are also raising consumer awareness of the nutritional value of their products through educational campaigns. This includes providing nutritional information, explaining the health benefits of the products and how snacking can be part of a balanced diet.

- Sustainability and Environmental Protection: As consumers pay more attention to environmental issues, snack manufacturers are also looking for more sustainable production methods, such as using renewable resources and reducing packaging waste.

- Technology Application: Leverage new technologies, such as data analytics and artificial intelligence, to better understand consumer behavior, optimize product development, and improve production efficiency.

- Diversified product lines: Expand product lines to include more types of snacks, such as organic snacks, allergen-free snacks and vegetarian snacks, to meet the needs of different consumer groups.